For Professional Real Estate Investors

Client Partner Business Manager

What's Included?

DealTrack™ SFR (1-4 Unit) Underwriting Models

Investors often grapple with the challenge of inaccurate financial projections and the absence of a comprehensive tool to analyze fix-and-flip, BRRR method, and long-term rental scenarios. Traditional calculators and analysis software fall short in incorporating essential variables, leading to suboptimal profit forecasts. With DealTrack™, investors gain access to institutional-quality Excel models, significantly enhancing accuracy in financial projections and vastly improving the investment decision-making process.

Value-Add (Fix & Flip/ BRRR) Features:

Dynamic leverage ratios based on deal specifics, credit and experience

Purchase or refinance modeling

ARV Calculator

Detailed closing cost calculator

Flip returns vs BRRR returns

5 Year Proforma for BRRR strategies

Stabilized (Rental) Features:

Dynamic leverage ratios based on deal specifics, credit and experience

Purchase or refinance modeling

Cash flow forecasting

Short vs Long-term rental comparison

Detailed closing cost calculator

IRR and EMx return metrics

5 and 10 Year Proforma statements

Masterclass: Ignite Your Returns and Steer Clear of Risky Deals

Use-case walk throughs

Underwrite RISK like an Investment Banker

Model the BRRR refinance BEFORE acquisition

Learn how to interpret operating statements

Industry standard terms and return metrics explained e.g. GPR, EGR, NOI, DSCR, EMx, IRR

Learn the third-party data providers we use EVERY DAY to size deals

Stabilized (Rental) Features:

Dynamic leverage ratios based on deal specifics, credit and experience

Purchase or refinance modeling

Cash flow forecasting

Short vs Long-term rental comparison

Detailed closing cost calculator

IRR and EMx return metrics

5 and 10 Year Proforma statements

DealTrack™ Budget Builder & Draws Management Model

The ultimate scope of work tool for rehab projects. Managing cash flow and project budgets effectively is a common challenge in rehab projects. Investors need a detailed and dynamic way to track project costs and manage cash flow. This model provides a structured approach to budgeting and cash flow management.

Masterclass: Estimate and Manage Your Project Like a Pro

Track line item completion and draw requests

Ensure adequate cash-on-hand throughout project

Reduce stress and improve project execution

MarketTrack™: The Essential Economic Indicators for Real Estate Investors

Navigating the constant stream of "breaking" financial news presents a formidable task when trying to decipher economic indicators and their relevance to real estate investment strategies.

This streamlines the comprehension of vital economic indicators, empowering investors to swiftly evaluate the prevailing phase of the economic cycle. Such clarity facilitates strategic investment decisions rooted in economic trends, potentially fostering improved market positioning and profitability.

Quick Reference Guide: Essential Economic Data Every Savvy Real Estate Investor Tracks

Key leading and lagging indicator

Data providers

Our preferred resource for tracking interest rates

Real Estate Investment Strategies by Economic Cycle Phase

Adapting investment strategies to different phases of the economic cycle can be complex and unclear.

This guide offers specific strategies tailored to each economic cycle phase, empowering investors to make informed decisions that align with current and forecasted market conditions. It enhances the ability to capitalize on opportunities and mitigate risks throughout economic cycles.

Quick Reference Guide: Your Go-To Resource for Essential Insights Across 8 Packed Pages

Expansion

Peak

Recession

Recovery

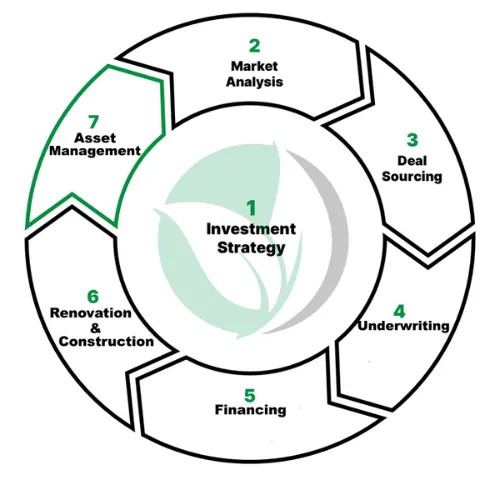

7 Pillar of Profit Framework

Resources to Scale Your Investment Company

1. Pick a Strategy

2. Find a Market

3. Find a Deal

4. Analyze a Deal

5. Finance a Deal

6. Manage your Deals

Meet Your Guide

My name is Dante' M. Shackelford, and as the Founder and Managing Principal of Financing Growth, I bring nearly two decades of expertise to the forefront of real estate finance and investment advisory. Throughout my career, I've successfully closed over 1200 real estate transactions, totaling nearly $400 million in volume. My extensive dealings have not only given me a deep understanding of market dynamics but also revealed a critical gap in support for small residential investors.

Unlike typical lenders who focus solely on selling loan products, at Financing Growth, we are committed to helping investors grow. Our approach goes beyond transactions; we provide a foundation of knowledge that transforms our clients from everyday investors into savvy professionals. This commitment is deeply rooted in my personal experiences with industry 'gurus' who, despite their best intentions, often lack fundamental investment knowledge. It's not uncommon to encounter celebrated experts who struggle with basic concepts like Net Operating Income (NOI). This widespread issue contributes to a cycle of the blind leading the blind, which we aim to correct.

At EMx University, we do more than just challenge this status quo—we revolutionize it. Our goal is to elevate the industry by offering institutional-quality training that's accessible not only to small investors but also to real estate agents, brokers, and yes, even the gurus themselves. By bridging the gap between amateur enthusiasm and professional expertise, EMx University is setting a new standard in real estate education.

Our courses and resources are crafted to empower you with the analytical tools and strategic insights that are typically reserved for the top echelons of the investment world. From understanding complex financial intricacies to mastering market cycles and economic indicators, our curriculum is designed to turn challenges into opportunities for growth and success.

Join me at EMx University, where we equip you with the knowledge to navigate the complexities of real estate investment with confidence. Together, we will redefine what it means to be successful in the competitive landscape of residential real estate. Let's elevate your expertise and transform your investment approach, paving the way for a future where your financial aspirations are not just met—they're exceeded.,

© 2026 EMx University, LLC

By visiting this page, you agree to terms and conditions, privacy policy & earnings disclaimer.

This site is not a part of the Facebook website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.

DISCLAIMER:

EMx University provides educational content, research, guides, and various tools to aid real estate professionals. EMx University is not a lender, mortgage broker, or finance company. Any references to financing or lending products are references to offerings from other affiliated companies. Use of affiliate company products and services is not a requirement for using or gaining value from EMx University's products and services.

EMx University does not offer investment opportunities. Instead, we provide analytical tools designed to help real estate professionals better measure and analyze their investments. The investment analysis and results discussed in this video are based on our models and experiences, and in some cases, those of our clients. These results are for illustrative purposes only and are not guarantees of future performance. Your results will vary and depend on many factors, including but not limited to your background, experience, financial situation, and work ethic. All investments entail risk and require significant effort and analysis. If you are not willing to accept these risks, please do not use the Deal Track Toolkit or any related products and services from EMx University.